In a striking change in the cryptocurrency market, Bitcoin’s short-term holders have just unloaded about $2.4 billion worth of assets as prices drop below $95,000. This comes as the U.S. government has been given the green light to liquidate $6.5 billion worth of Bitcoin seized from the Silk Road marketplace. These events raise important questions regarding market stability and future price action, depicting a critical time for Bitcoin holders and the whole cryptocurrency market.

Short-Term Holders Offload $2.4 Billion

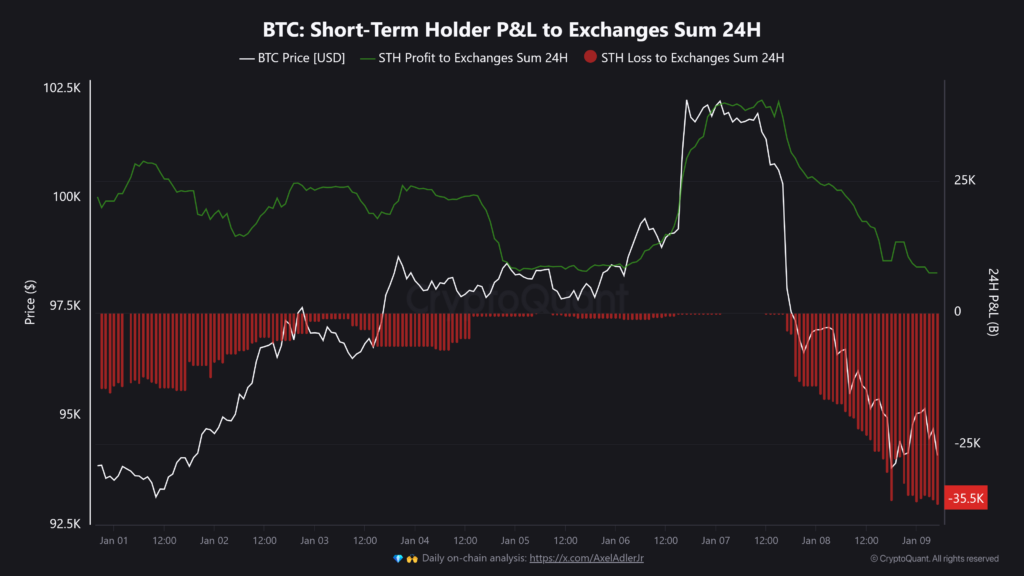

According to the latest CryptoQuant market analysis, Bitcoin short-term holders have reacted quite firmly to the recent price drop. The average daily realized profit has dropped dramatically from $136 million to $93 million, hinting at a cooling phase for the largest cryptocurrency. The fall in realized profits hints at most investors trying to secure gains or cut losses as market conditions worsen.

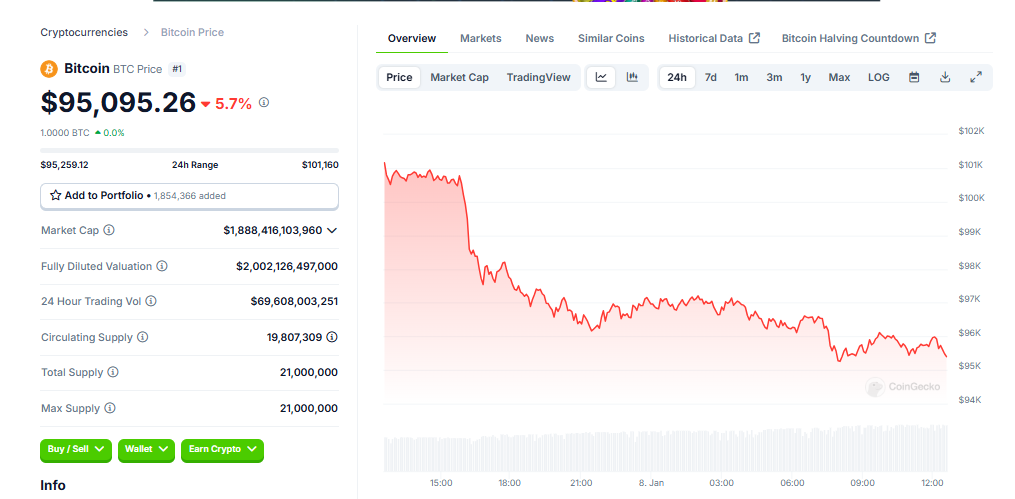

Realized profit levels, while down from the peaks during the 2021 cycle, remain strong and continue to reflect activity and resilience in the market. Bitcoin’s price has lately hovered around $93,000 to $95,400 following a failure to hold above the critical $100,000 threshold. Analysts are now watching this level of support closely for any potential breach that might signal deeper corrections and higher volatility.

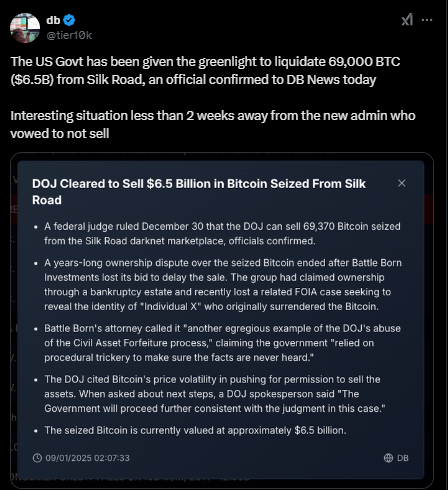

U.S. Government to Sell $6.5 Billion in Bitcoin

In another important development, the U.S. government has been cleared to sell 69,370 BTC valued at an estimated $6.5 billion. This follows a federal court decision that expedited the sale citing price volatility. The Department of Justice said it would proceed with the sale even with an impending change in administration, which traditionally had a bearing on its approach toward crypto assets.

Most previous government sales of Bitcoin have almost always caused price corrections, now raising new questions regarding the liquidity and sentiment of the market. Especially critical in terms of timing, this sale comes as the new administration recently announced intentions to retain seized Bitcoin as part of a strategic reserve, further complicating the market landscape.

Market Implications and Analysis

The combined effect of short-term holders dumping large quantities of Bitcoin and the impending government sale has left investors in a state of fear, doubt and uncertainty. Analysts point to the $95,000 level as the support that has become very instrumental in the stability of Bitcoin’s price. Failure to hold this level could see a cascade of sell-offs, further pulling down the price.

As Bitcoin consolidates following the short-lived rise above $100,000, there are mixed feelings among market players. Bulls are waiting to see another leg higher, while bears are waiting for potential retracements to make a move. According to historical data, a bullish rally tends to start when realized profits are substantially lower. In the past, for example, the mini-bullish rallies of September 2021 began after average daily realized profits of about $15 million were recorded, which is far below current levels.

The current average daily realized profit of $93 million, although lower than the peak, still indicates strong market activity. To some analysts, such high realized profit levels mean there is still considerable buying power left that could potentially act as a catalyst for a future rally.

Technical Indicators and Key Levels to Watch

At the moment, Bitcoin is trading around $95,400 after some key levels were broken, including the psychological $100,000 mark and critical moving averages: 4-hour 200 MA at $98,290 and EMA at $96,480. These breaks hint at short-term bearish price action and started to raise concerns among investors regarding further downside.

Despite this selling pressure, some analysts are pointing out that it may be a move to generate liquidity before another upward push. This kind of volatility usually occurs during consolidations near critical levels, more so after a big rally. The current situation highlights the importance of watching Bitcoin’s movements in relation to these critical technical levels.